Bond Sinking Fund Define

What is a Bond Sinking Fund. It provides some security to bond holders since it improves the likelihood that the issuer will eventually retire the associated bonds.

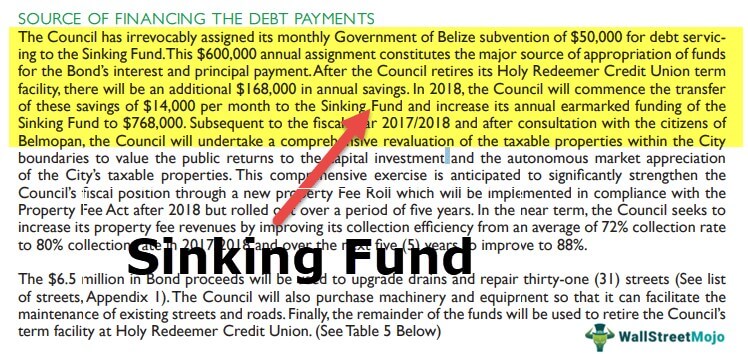

To ensure theres money on hand to redeem a bond or preferred stock issue a corporation may establish a separate custodial account called a sinking fund to which it adds money on a regular basis.

Bond sinking fund define. Mandatory Sinking Fund Requirements means amounts required by proceedings to be deposited in a year or fiscal year in a bond retirement fund for the purpose of paying the principal of securities that is due and payable in a subsequent year or fiscal year. A bond sinking fund is referred to those restricted assets of a company that are redeemed by the company to buy back some of its bonds payable. Home Bookkeeping What is a bond sinking fund.

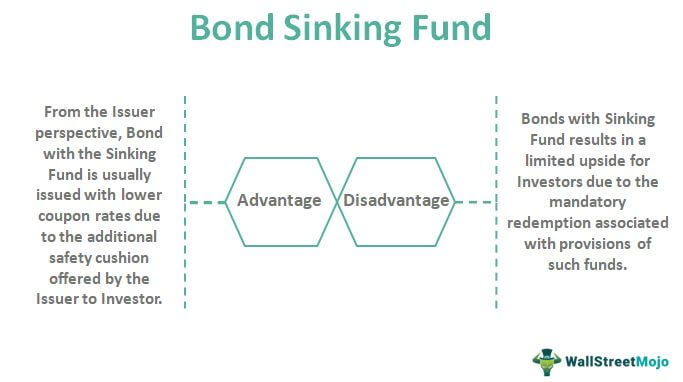

For bonds a sinking fund provides investors with assurance that the issuer will be responsible for setting aside earnings and retiring the debt. Jun 1 2020 Bookkeeping by Adam Hill. Sample 1 Sample 2 Sample 3.

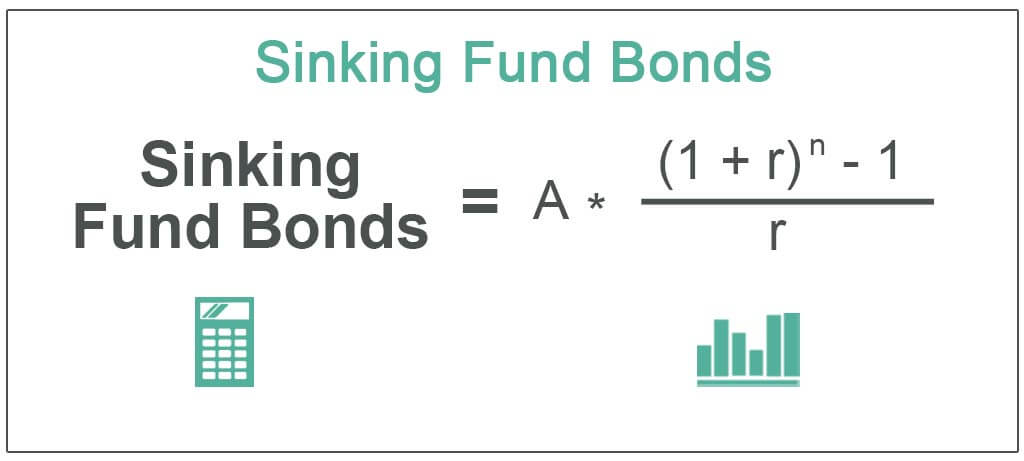

The bond sinking fund begins when the corporation deposits money with an independent trustee. The firm has the option to. A bond with a fund or account into which an issuer deposits money on a regular basis to repay the bond when it matures.

A sinking fund is maintained by companies for bond issues and is money set aside or saved to pay off a debt or bond. For example if a company issues a bond with a balloon maturity of seven years one may put money into a bond sinking fund for seven years. The existence of this fund is beneficial in the following ways.

The firm may repurchase a fraction of the outstanding bonds in the open market each year. A bond issued with a provision that a specified amount or percentage of the issuers income will be paid annually into a sinking fund set up to retire the bond issue. It takes off once the company deposits money with the help of an independent trustee.

A convertible bond is a fixed-income corporate debt security that yields interest payments but can be converted into a predetermined number of common stock or equity shares. A bond sinking fund is a restricted asset of a corporation that was required to set aside money for redeeming or buying back some of its bonds payable. Or the corporation may be required to establish such a fund to fulfill the terms of its issue.

Bonds issued with sinking. Sample 1 Sample 2 Sample 3. In other words its a bond that requires the issuing entity to create a sinking fund to be used as collateral in case the.

Failure to do so would mean that all the bonds principal would come due on the maturity date. A sinking fund may operate in one or more of the following ways. The conversion from the bond to stock can be done at certain.

A bond sinking fund is an escrow account into which a company places cash that it will eventually use to retire a bond liability that it had previously issued. The firm may repurchase a fraction of outstanding bonds at a special call price associated with the sinking fund. Definition of sinking-fund bond.

A sinking fund bond is a bond that requires the issuer to set aside a specific amount of assets on certain dates to repay bondholders. Sinking Fund Requirement means for any fiscal year or calendar year the principal amount of Term Bonds required to be purchased redeemed or paid at maturity in such year as established by the ordinance of the City authorizing the issuance of such Term Bonds.

Net Worth Worksheet Discover Your Net Worth Money Management Printables Net Worth Money Printables

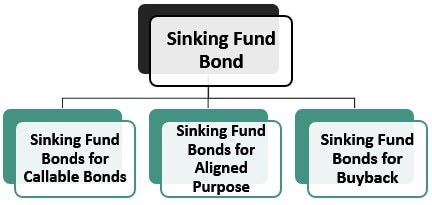

What Is Sinking Fund Bonds Definition Examples Top 3 Types

Founders Stock Meaning Features And Importance Financial Management Accounting And Finance Money Management

Bond Sinking Fund On Balance Sheet Youtube

Alternative Investment Meaning Features And Types Money Management Advice Finance Investing Investing

Economic News Calendar Indicator Free Download Https Forexinworld Com Economic News Calendar Iidicator F Financial Information Forex Financial Markets

Bond Sinking Fund On Balance Sheet Definition Accounting Example

Net Worth Update 6 July 2019 From One Geek To Another Net Worth Financial Independence Retire Early Sinking Funds

Sinking Fund Provision Examples How Sinking Funds Work In Bonds

Product Mix Meaning Dimensions Importance And More Financial Management Marketing Mix Marketing Concept

Personal Finances Should Be Personal Personal Finance Finance Personal Finance Advice

Pin On Liquidity Ratio Analysis

Growth Fund Definition Https Forexinworld Com Growth Fund Forex Forextrader Investment Forexinworld Fund Growth Forex

Business Case Website Deliver The Better Business Case Business Case Business Case

What Is Sinking Fund Bonds Definition Examples Top 3 Types

Bridge Loan Bridge Loan Money Management Advice Accounting And Finance

Yield Curve What It Is And Why It Is So Important Yield Curve Finance Investing Accounting And Finance

Posting Komentar untuk "Bond Sinking Fund Define"