What Is The Meaning Of Sinking Fund In Accounting

The fund gives bond investors an added element of security. Similarly you or someone in your family can create a sinking fund dedicating a savings account for a specific household expense that may be too large to handle without borrowing the money.

15 Sinking Fund Categories You Need In Your Budget Rinkydoo Finance

The fund is usually part of the service charge that is payable by each leaseholder and Home Uncategorized Sinking funds for leasehold properties.

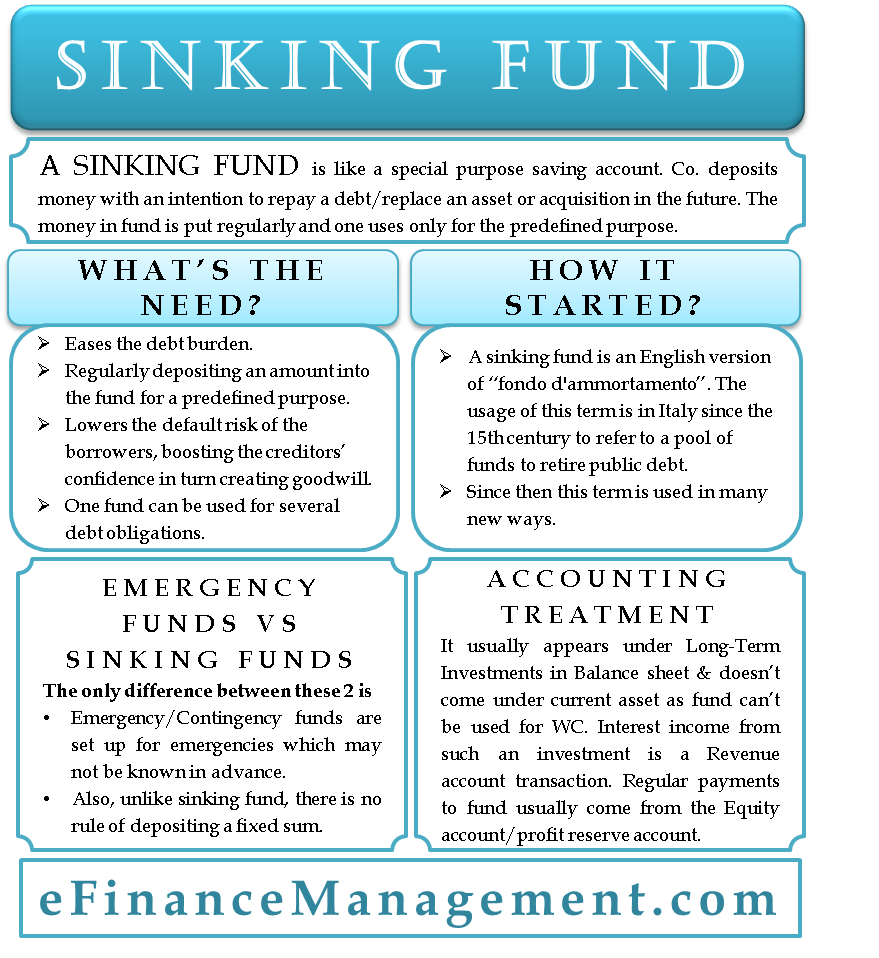

What is the meaning of sinking fund in accounting. So the sinking fund is like a recurring deposit. Such funds are quite common with leasehold properties. It is reported in the Asset section of the Balance Sheet under the Long Term Asset Head within the Investment classification.

Because this money will be spent soon it is often not included in a net worth calculation. Having a sinking fund in place is not only essential to the upkeep of your home but also maintains the value and saleability of the property. By definition a sinking fund is a long-term savings account which ensures that there is capital set aside to cover one-off expenses in the future.

In other words it literally saves an organized legal entity from. A sinking fund is a type of fund that is created and set up purposely for repaying debt. Depreciation is charged every year to the profit and loss Ac.

It is a long-term asset that is created solely for the purpose of retiring bonds. Home Accounting Dictionary What is a Sinking Fund. Sinking fund method is used when the cost of replacement of an asset is too large.

Sinking funds may help pay off the debt at maturity or assist in buying back bonds on the open market. A sinking fund is a kind of fund in which a fixed amount is deposited at a regular interval. The owner of the account sets aside a certain amount of money regularly and uses it only for a specific purpose.

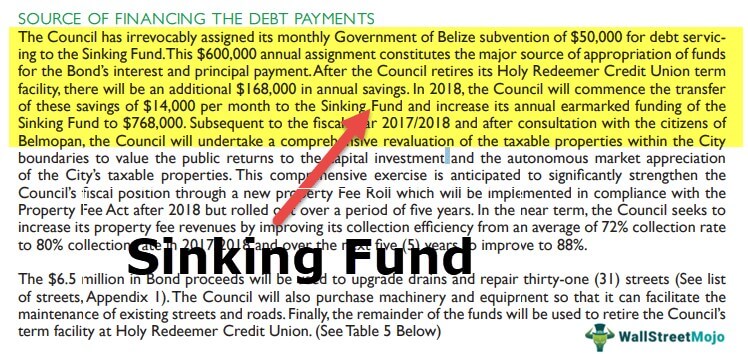

To ensure theres money on hand to redeem a bond or preferred stock issue a corporation may establish a separate custodial account called a sinking fund to which it adds money on a regular basis. A sinking fund is an account containing money set aside to pay off a debt or bond. Or the corporation may be required to establish such a fund to fulfill the terms of its issue.

A sinking fund reduces the availability of cash for the borrower which narrows the range of its investment choices. After some years this fund turns into a. It is a financial technique of ensuring that a monetary lack does not arise causing any hardships in case of insufficient funds.

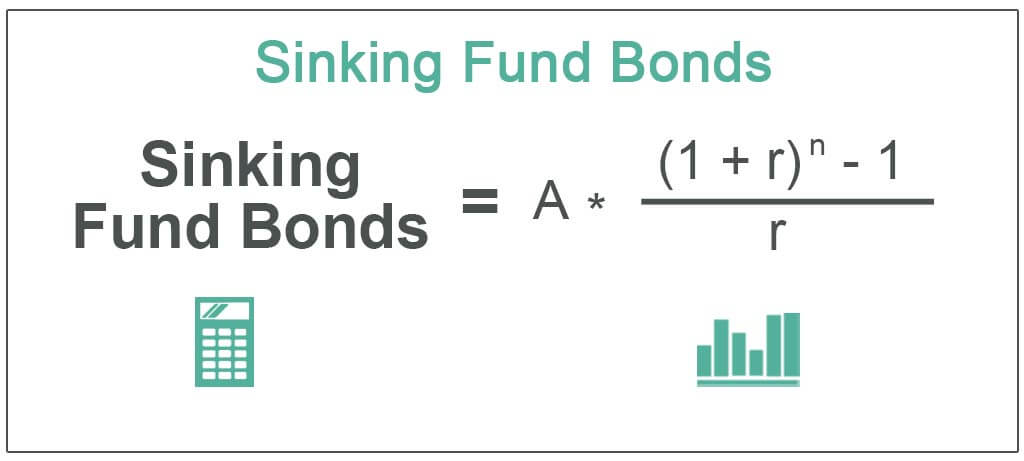

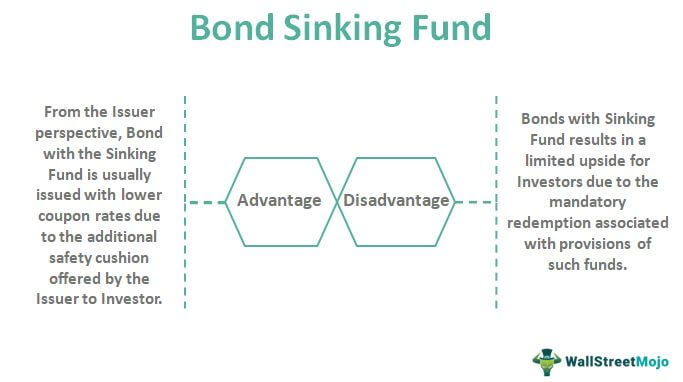

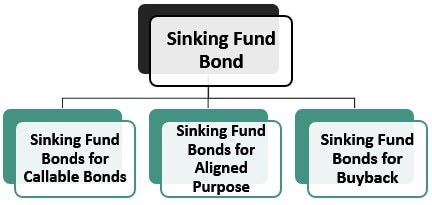

Bondholders can then convert into equity shares should the company perform well. A sinking fund bond is a bond that requires the issuer to set aside a specific amount of assets on certain dates to repay bondholders. Often it is used by corporations for bonds and deposits money to buy back issued bonds.

The sinking fund method is a technique for depreciating an asset while generating enough money to replace it at the end of its useful life. Thus the sinking fund method is used. A sinking fund is a specific and intentional type of savings account.

The money you accumulate in this type of account is spent in somewhat of a short term. A sinking fund is an account that is used to deposit and save money to repay a debt or replace a wasting asset in the future. A deferred item in accrual accounting is any account where a revenue or expense recorded as an liability or asset is not realized until a future date accounting period or until a transaction is completed.

Accounting Treatment of Bond Sinking Fund. We will explain later how your sinking fund differs from your emergency fund. It is not classified under Current Assets.

Current Assets Current assets refer to those short. A sinking fund is an amount of money which is set aside to cover any major work which is needed on a property in the future. In other words its a bond that requires the issuing entity to create a sinking fund to be used as collateral in case the.

But it may sometimes happen that the amount is not readily available at the time of purchase of the new asset. The conversion price and ratio can be found in the bondindenturein the case of convertible. In other words its like a savings account that you deposit money.

A benefit of separating your sinking funds from your savings accounts is the psychology of saving. In general parlance a Sinking Fund is money set aside in a separate account to pay off a debt a way to generate funds for a depreciating asset to pay off a future expense or repay long-term debt. A sinking fund is an account a corporation uses to set aside money earmarked to pay off the debt from a bond or other debt issue.

This occurs because available cash is constantly being funneled into the sinking fund rather than being deployed to earn a return. The existence of the fund allows the corporation to present its investments as safer than those issued by a.

Sinking Funds How Do They Work How Do I Use Them Budgeting Is A Challenge

What Is Sinking Fund Bonds Definition Examples Top 3 Types

Sinking Funds Why You Need Them How To Start Clever Girl Finance

Sinking Funds Why You Need Them How To Start Clever Girl Finance

What Is A Sinking Fund Creditrepair Com

Sinking Fund Definition Examples And Advantages

Sinking Fund A Fund To Help You Sink Your Debt

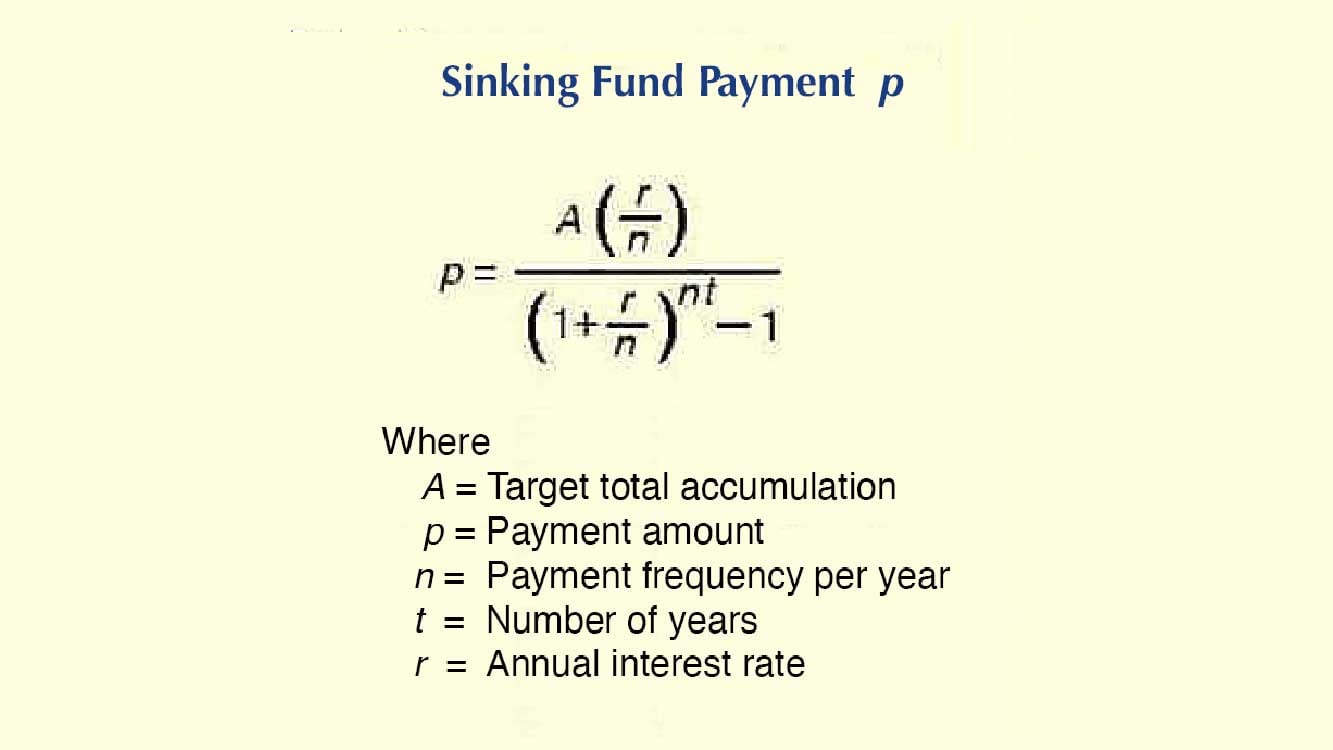

Chapter 3 Mathematics Of Finance Section 3 Future Value Of An Annuity Sinking Funds Ppt Download

Sinking Fund Builds Savings For Specific Purpose Or Sinking Debt

Bond Sinking Fund On Balance Sheet Youtube

Bond Sinking Fund On Balance Sheet Definition Accounting Example

18 Sinking Fund Categories You Might Need In Your Budget The Mostly Simple Life

Sinking Fund A Fund To Help You Sink Your Debt In 2021 Finance Investing Accounting And Finance Accounting

3 Ways To Create Sinking Funds The Mostly Simple Life

Sinking Fund Method For Calculating Depreciation Qs Study

Sinking Fund Provision Examples How Sinking Funds Work In Bonds

Bond Sinking Fund On Balance Sheet Youtube

What Is Sinking Fund Bonds Definition Examples Top 3 Types

Sinking Fund Builds Savings For Specific Purpose Or Sinking Debt

Posting Komentar untuk "What Is The Meaning Of Sinking Fund In Accounting"